What is Refinancing?

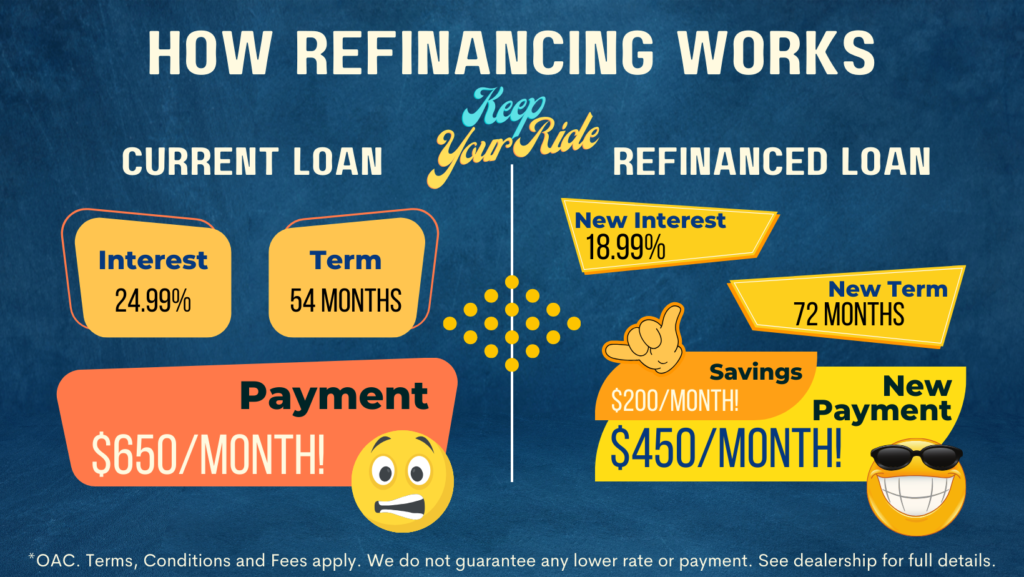

Refinancing is different than a trade in, because you get too keep the vehicle you are currently driving! Why is that advantageous? Because you can potentially lower your interest rate, extend your term, purchase a warranty and not have to worry about any negative equity.

How Does It Work?

It’s pretty straight forward – send us a refinancing application (below), and we’ll get it in front of our refinance lender partners. They’ll come back with a yes or no, and we’ll provide you with the new terms. If you wish, you may also purchase an extended vehicle warranty. If you approve the new terms, we’ll complete the paperwork, pay out your existing loan and initiate your new loan. You keep your car, and get the benefits of the lower rate and/or the longer term!

*This is an example only for illustration purposes – each refinancing application is unique, and subject to applied credit, terms, rates and fees. Contact the dealership for full details.

Additional benefits

You also have the opportunity to put down an additional deposit, thus lowering your payments and cost of borrowing further. You also can choose to purchase an Extended Vehicle Warranty to protect your vehicle for the future.